What Is a Blockchain? — How It Works, Types, Use Cases, and the Road Ahead

What Is a Blockchain? — How It Works, Types, Use Cases, and the Road Ahead

Published in August 2025 | Category: Crypto

What Is a Blockchain?

At its core, a blockchain is a distributed digital ledger that records transactions across a network of computers. Once recorded, these transactions cannot be altered retroactively without altering all subsequent blocks and gaining consensus from the entire network.

Each entry on the blockchain is grouped into a “block.” These blocks are linked or “chained” together using cryptographic techniques—hence the name blockchain. The result is a transparent, secure, and immutable ledger of activity.

Table of Contents

- Key Characteristics

- How Does Blockchain Work?

- Public vs. Private Blockchains

- Why Blockchain Matters for Cryptocurrencies

- Smart Contracts: Blockchain’s Evolution

- Blockchain Beyond Crypto: Real-World Use Cases

- Challenges and Limitations of Blockchain

- What’s Next for Blockchain Technology?

- Conclusion: The Backbone of a Decentralized Future

Key Characteristics

Decentralized

A decentralized blockchain is maintained by many independent nodes (computers) that store and verify the ledger, rather than a single authority. Anyone can join and help secure the network on public chains (permissionless), while permissioned or private chains restrict participation to approved entities. Decentralization reduces single points of failure and censorship risk.

How it’s achieved: a large, geographically distributed set of nodes; open participation; and a consensus mechanism (e.g., Proof of Work or Proof of Stake) that aligns incentives and makes it costly to cheat.

Trade-offs and nuance: decentralization can reduce throughput (fewer transactions per second) compared with centralized databases. In practice, it’s a spectrum: public chains may still face centralizing pressures (e.g., mining pools or large validator sets), and layer-2 solutions can introduce operational centralization.

Immutable

Immutability means data is effectively append-only: once a transaction is included in a block and secured by consensus, altering it would require re-writing that block and every subsequent block—something that is computationally and economically prohibitive on well-secured networks.

How it’s achieved: cryptographic hash links between blocks (each block header encodes the previous block’s hash) and Merkle trees that commit all transactions in a block. Any tampering changes the hashes, immediately exposing the alteration.

Finality in practice: on PoW chains, immutability is probabilistic—the chance of a reorganization drops as you wait for more confirmations. On PoS chains with finalized checkpoints, immutability becomes economic—reverting finalized blocks would slash staked collateral. In permissioned chains, immutability ultimately depends on the governance rules of the consortium.

Transparent

Public blockchains offer transparency: all transactions are recorded on a shared ledger that anyone can independently verify using a node or a block explorer. Addresses are typically pseudonymous (not inherently tied to a real identity), enabling open auditability without a central auditor.

Benefits: verifiable supply, traceable flows, and simplified audits for on-chain activity. Limitations: transparency can conflict with privacy; advanced analytics can cluster addresses. Some networks and tools add privacy layers (e.g., zero-knowledge proofs), while enterprise/permissioned blockchains restrict transparency to approved participants for compliance reasons.

This content may interest you!

Time-stamped

Every block is time-stamped (e.g., a Unix timestamp in the block header) and linked to its predecessor, establishing a canonical ordering of transactions over time. This ordering enables features like time locks, expiring orders, and predictable settlement windows.

Accuracy and use: block time is a network-level clock—useful for sequencing and smart-contract logic—but not a perfect wall-clock. Different chains have different block intervals (e.g., ~10 minutes on Bitcoin; seconds on many PoS chains). Some networks apply safeguards (e.g., median-time rules) to prevent miners/validators from abusing timestamps.

How these properties work together

- Decentralization ↔ Immutability: more independent nodes and stronger economic security make rewriting history prohibitively expensive.

- Transparency ↔ Privacy: public verifiability improves auditability but may require privacy-preserving techniques for sensitive use cases.

- Time-stamps ↔ Smart contracts: reliable sequencing enables on-chain automation (escrows, unlock schedules, auctions) without a trusted scheduler.

How Does Blockchain Work?

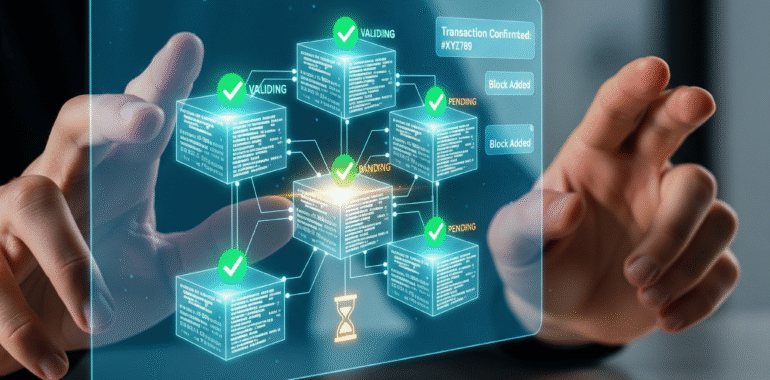

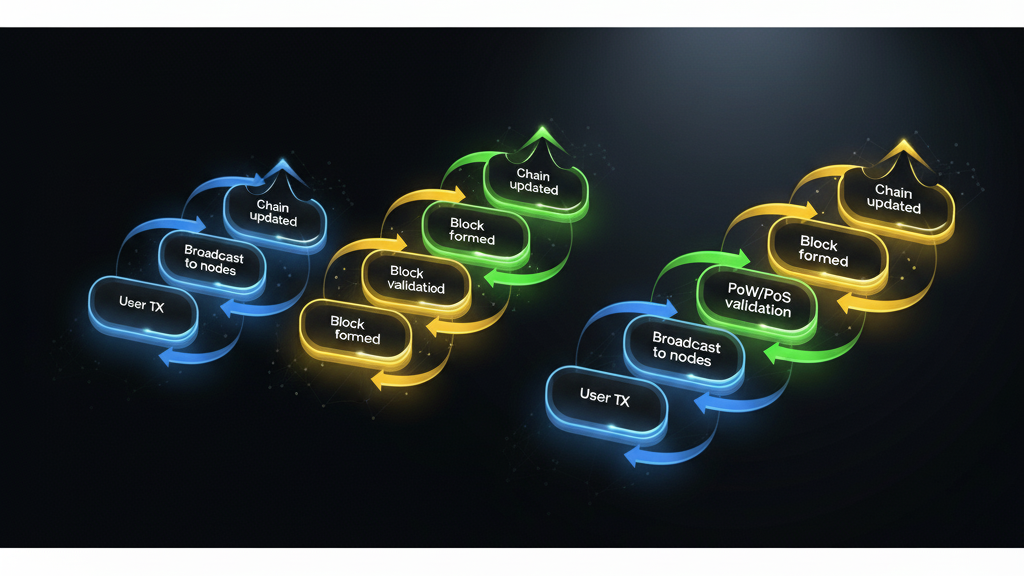

Here’s a simplified step-by-step of how blockchain transactions are processed:

- A transaction is initiated by a user—this could be sending crypto, signing a smart contract, or even registering property.

- The transaction is broadcast to a decentralized network of nodes (computers).

- Nodes validate the transaction using consensus algorithms like Proof of Work (PoW) or Proof of Stake (PoS).

- The transaction is grouped into a block with others, and that block is validated and added to the chain.

- The chain is updated, and the transaction becomes publicly verifiable.

The validation process is essential for preventing fraud, ensuring data integrity, and eliminating the need for a centralized authority (like a bank).

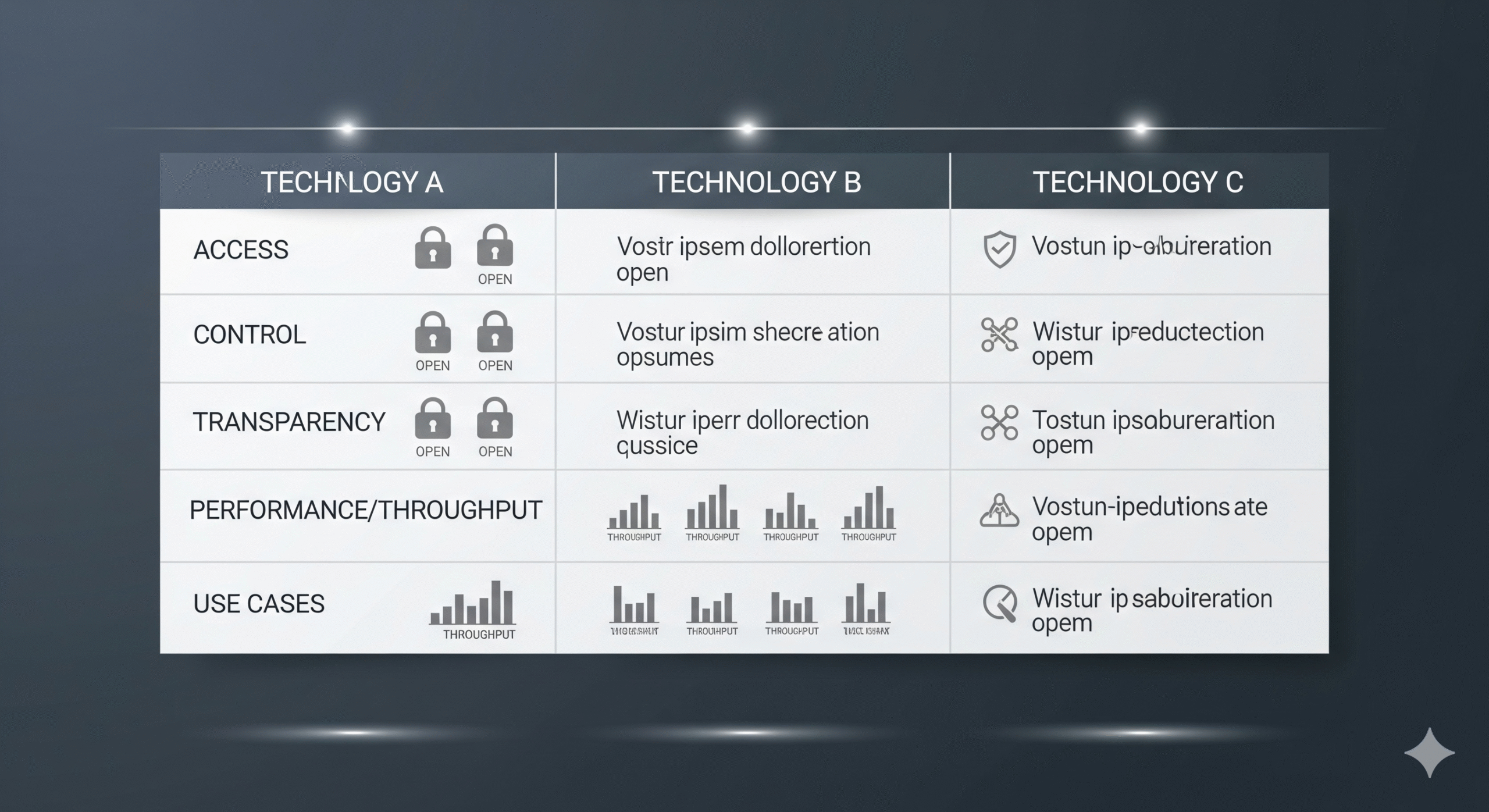

Public vs. Private Blockchains

There are different types of blockchains based on who can access and control the ledger:

1. Public Blockchains

- Open to anyone (e.g., Bitcoin, Ethereum).

- Fully decentralized.

- Secure but may be slower and require more energy.

- Ideal for cryptocurrencies and open financial systems.

2. Private Blockchains

- Controlled by a single organization or consortium (e.g., Hyperledger).

- Access is permissioned.

- Faster and more scalable, but less transparent.

- Common in enterprise solutions like supply chain or banking.

3. Consortium Blockchains

- A hybrid model with multiple organizations sharing control.

- Balances transparency and efficiency.

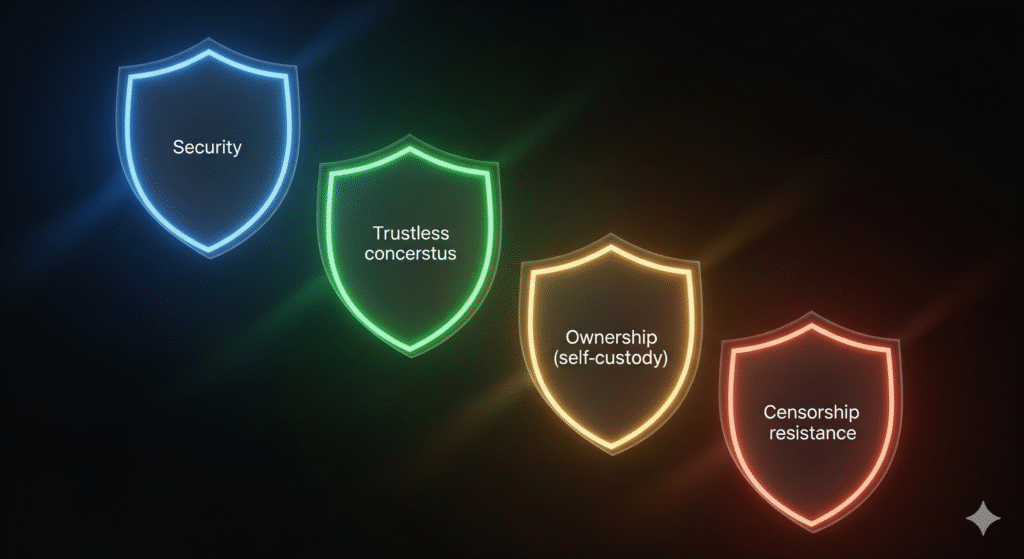

Why Blockchain Matters for Cryptocurrencies

Cryptocurrencies wouldn’t exist without blockchain. It provides the trustless infrastructure needed to transfer value digitally without intermediaries.

Here’s why it’s crucial:

- Security – Transactions are encrypted and verified across thousands of nodes.

- Trust – Users don’t need to trust each other; they trust the math and consensus.

- Ownership – You truly own your crypto assets; they aren’t held in a centralized database.

- Resistance to Censorship – Because no single entity controls the blockchain, governments or institutions can’t easily block or reverse transactions.

Smart Contracts: Blockchain’s Evolution

One of blockchain’s most impactful innovations is smart contracts—self-executing agreements coded directly onto the blockchain. These allow for the automation of complex financial processes without human intervention.

Examples include:

- Decentralized finance (DeFi) platforms.

- NFT marketplaces.

- Blockchain-based insurance claims.

Ethereum was the first blockchain to popularize smart contracts, but platforms like Solana, Cardano, and Polkadot have built on this foundation.

Blockchain Beyond Crypto: Real-World Use Cases

While blockchain powers cryptocurrencies, its applications go far beyond:

- Supply Chain Management: Tracking goods from origin to delivery (e.g., IBM Food Trust).

- Healthcare: Securing patient data and enabling health record interoperability.

- Voting Systems: Tamper-proof digital voting (pilot projects in Estonia and West Virginia).

- Digital Identity: User-controlled identity with decentralized IDs (DIDs).

- Real Estate: Tokenizing property and streamlining title transfers.

Challenges and Limitations of Blockchain

Despite its promise, blockchain still faces obstacles:

- Scalability – Networks like Ethereum often face congestion.

- Energy Consumption – PoW blockchains require substantial computational power.

- Regulation – Global legal frameworks are still evolving.

- Interoperability – Many blockchains can’t communicate with each other easily, though projects like Polkadot and Cosmos aim to fix this.

What’s Next for Blockchain Technology?

The future of blockchain will likely be shaped by these trends:

- Mass Adoption: As UX improves and gas fees drop, mainstream users will increase.

- Layer 2 Scaling: Technologies like Optimism, Arbitrum, and zk-Rollups will make blockchains faster and cheaper.

- Green Consensus Models: Proof of Stake and alternatives will reduce environmental impact.

- Enterprise Integration: More traditional companies will use private blockchains for efficiency.

- Interoperability: Cross-chain ecosystems will enable seamless asset movement and smart contract interaction.

Conclusion: The Backbone of a Decentralized Future

At its core, blockchain is not just a new database—it is a new trust model. By combining decentralization, immutability, transparency, and time-stamped ordering, blockchains allow multiple parties to share a consistent state without a central coordinator. These properties reinforce one another: broad participation hardens security and makes history costly to rewrite; public verifiability improves auditability; and reliable sequencing enables programmable, autonomous workflows on-chain.

The design, however, comes with trade-offs. Public chains must balance throughput, fees, and decentralization; transparency can clash with privacy; and real-world deployments introduce questions of governance, compliance, and user experience. The next wave of innovation—layer 2 scaling, zero-knowledge proofs, energy-efficient Proof of Stake, and cross-chain interoperability—is aimed at easing these constraints without diluting the core guarantees that make blockchains useful.

For practitioners, the pragmatic approach is to match the tool to the job. Developers and enterprises should assess a network’s finality model (probabilistic vs. economically finalized), data visibility requirements (public vs. permissioned), and operational risks (validator concentration, custody, key management). Users and policymakers should focus on how on-chain assurances replace traditional intermediaries—what costs they lower, what risks they shift, and which guarantees truly matter in a given use case.

As these systems mature, blockchains will increasingly fade into the background—powering finance, identity, supply chains, and media the way the internet powers everyday applications today. Their long-term relevance will be measured less by speculation and more by reliable settlement, programmable coordination, and verifiable data that people and institutions can depend on. Understanding the interplay of decentralization, immutability, transparency, and time-stamps is the first step toward building—and using—systems that deserve that trust.