¿What Are Cryptocurrencies?

¿What Are Cryptocurrencies?

Published in August 2025 | Category: crypto

Table of Contents

- What Are Cryptocurrencies?

- The Genesis of Cryptocurrency

- How Do Cryptocurrencies Work?

- Key Features of Cryptocurrencies

- Cryptocurrency vs. Central Bank Digital Currencies (CBDCs)

- Use Cases of Cryptocurrencies

- Challenges and Risks

- Societal Impact and Philosophy

- Conclusion

What Are Cryptocurrencies?

Cryptocurrencies are digital or virtual currencies that use cryptographic techniques to secure financial transactions, control the creation of new units, and verify the transfer of assets. Unlike traditional fiat currencies issued by governments and regulated by central banks, cryptocurrencies are decentralized and typically run on blockchain technology — a distributed ledger that operates without central authority.

The idea of digital currency is not new. However, cryptocurrencies brought the concept to life in a way that combines decentralization, privacy, transparency, and immutability. The term “cryptocurrency” is derived from two components: crypto, referring to cryptography, and currency, which implies the medium of exchange.

📌 The Genesis of Cryptocurrency

In 2008, a person or group of people using the pseudonym Satoshi Nakamoto published a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” It proposed a new form of money that would allow online payments to be sent directly from one party to another without going through a financial institution.

In January 2009, Nakamoto launched the Bitcoin network by mining the first block, known as the Genesis Block. This marked the beginning of the cryptocurrency era. Bitcoin introduced a revolutionary solution to the problem of trust in online transactions by using a decentralized and transparent ledger — the blockchain.

🔐 How Do Cryptocurrencies Work?

Cryptocurrencies operate on a blockchain, which is a distributed, public ledger that records every transaction made using that currency. Each transaction is verified by network participants (called nodes), and once confirmed, the data is permanently added to a “block” and linked to the chain.

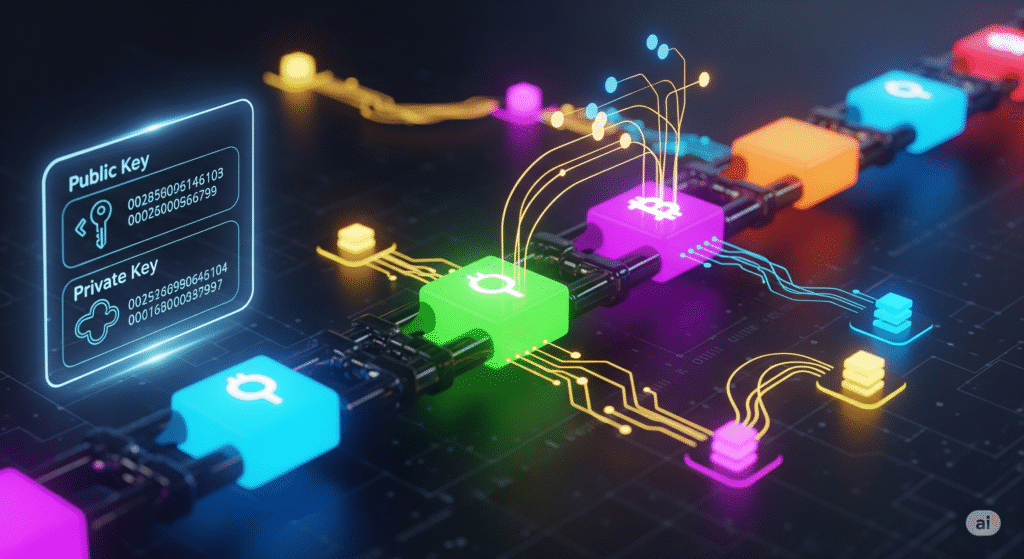

Each user has a digital wallet, consisting of public and private keys:

- The public key is like an email address — you can share it to receive funds.

- The private key is like your password — it must be kept secret to access and authorize spending.

Transactions are validated using consensus mechanisms, such as:

- Proof of Work (PoW): Used by Bitcoin, requires miners to solve complex puzzles.

- Proof of Stake (PoS): Validators are selected based on how much cryptocurrency they hold and “stake” as collateral.

🌐 Key Features of Cryptocurrencies

- Decentralization: No central authority, such as a bank or government, controls the network. All operations are distributed across thousands of independent nodes.

- Transparency: All transactions are recorded on the public blockchain. Anyone can audit or trace the movement of funds.

- Immutability: Once a transaction is added to the blockchain, it cannot be changed or reversed, making it tamper-resistant.

- Security: Advanced cryptographic algorithms protect wallets and transactions, reducing the risk of fraud.

- Global Access: Anyone with an internet connection can create a wallet and use cryptocurrencies, making them accessible to the unbanked and underbanked populations.

You might also like!

💸 Cryptocurrency vs. Central Bank Digital Currencies (CBDCs)

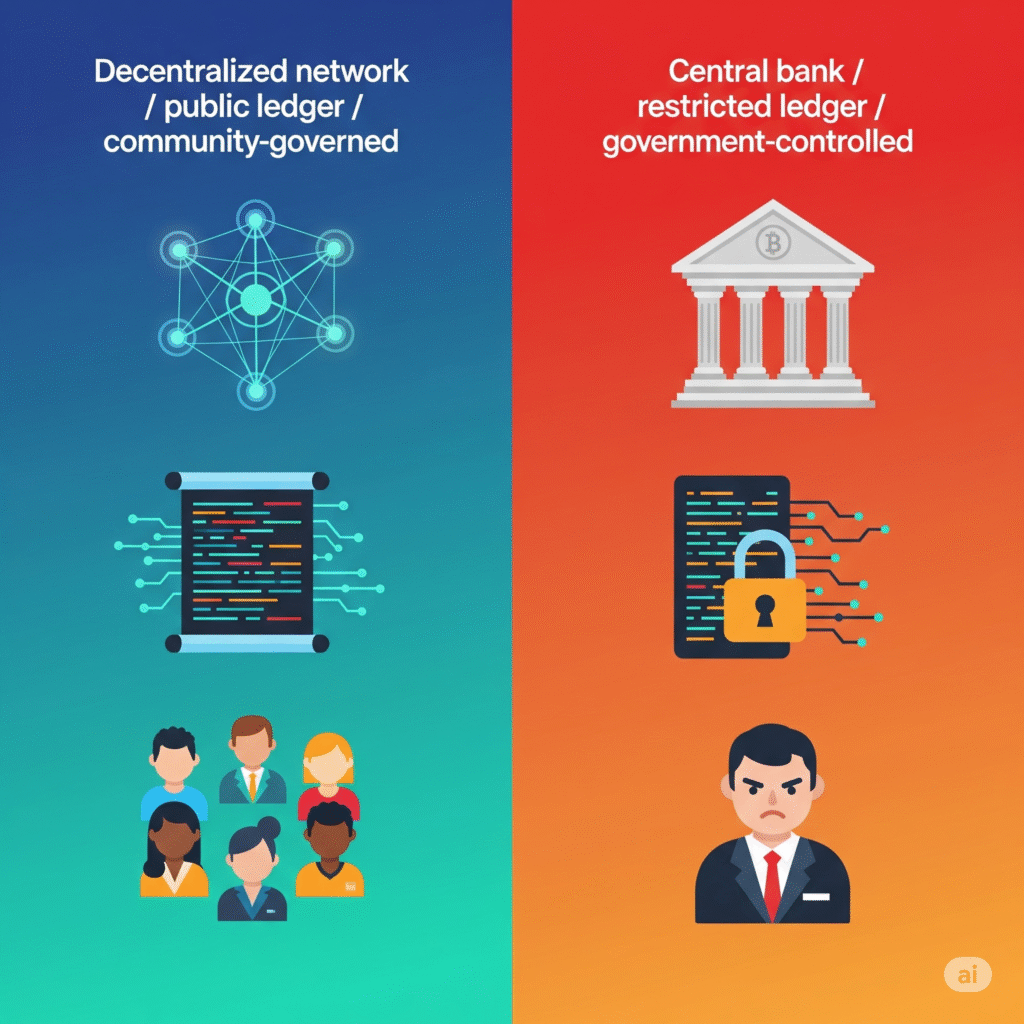

While cryptocurrencies are decentralized, CBDCs are digital versions of a country’s fiat currency issued and controlled by the central bank. For example:

- China’s Digital Yuan

- The e-Naira from Nigeria

- The Digital Euro (in development)

| Feature | Cryptocurrency | CBDC |

|---|---|---|

| Issuer | Decentralized network | Central Bank |

| Transparency | Public ledger | Private or restricted ledger |

| Privacy | Variable, sometimes anonymous | Usually traceable by authorities |

| Control | Community or algorithm | Government authority |

CBDCs may enhance monetary policy and improve payment systems, but they differ philosophically from cryptocurrencies, which were designed to resist centralized control.

🔍 Use Cases of Cryptocurrencies

- Remittances: Faster, cheaper international money transfers.

- Store of Value: Like digital gold (e.g., Bitcoin).

- Decentralized Finance (DeFi): Lending, borrowing, and trading without banks.

- Digital Identity: Secure, blockchain-based ID systems.

- Gaming and NFTs: Token economies in virtual worlds.

📉 Challenges and Risks

- Volatility: Prices can fluctuate dramatically.

- Regulatory Uncertainty: Governments have inconsistent policies across regions.

- Scams and Hacks: Users must be cautious of fraudulent schemes.

- Environmental Concerns: PoW systems consume large amounts of energy.

🌍 Societal Impact and Philosophy

- In countries with hyperinflation, crypto offers a way to preserve value.

- For citizens under authoritarian regimes, it provides a censorship-resistant tool.

- Philosophically, cryptocurrencies represent a bottom-up revolution, challenging top-down control of money.

✅ Conclusion

Cryptocurrencies are more than just a technological trend — they represent a shift in how we define and use money. By eliminating intermediaries and enabling trustless, decentralized transactions, cryptocurrencies have the potential to disrupt traditional financial systems, empower individuals, and reshape economies.

As adoption increases and innovation continues, cryptocurrencies are likely to become an integral part of the digital future. However, this transformation will depend heavily on how challenges around regulation, scalability, and security are addressed in the coming years.