Understanding Inflation: What It Is and How It Affects Your Money

Understanding Inflation: What It Is and How It Affects Your Money

Published July in 2025 | Finance

Table of Contents

- What Is Inflation?

- Causes of Inflation

- How Inflation Affects Your Money

- Historical Examples of Inflation

- How to Defend Against Inflation

- Inflation and the Federal Reserve

- Inflation in Retirement Planning

- Inflation: Friend or Foe?

- Conclusion

What Is Inflation?

Inflation is the overall rise in price of goods and services in an economy, here, UK, over a period of time. Buyers, of course, experience the opposite: When inflation goes up, the dollar’s purchasing power goes down, so now each dollar buys less of something than it used to.Common Example: If that same loaf of bread cost $2 last year, but costs $2.20 today, that 10 percent increase in price shows inflation. Your money doesn’t go as far as it used to.

Inflation is most frequently tracked by the Consumer Price Index (CPI), a measure of price movements of the weighted-average household purchases of goods and services, including food, housing, clothing, and medical care.

This article may also interest you!!

Causes of Inflation

There are many causes of inflation, which can usually be divided into two justifications:

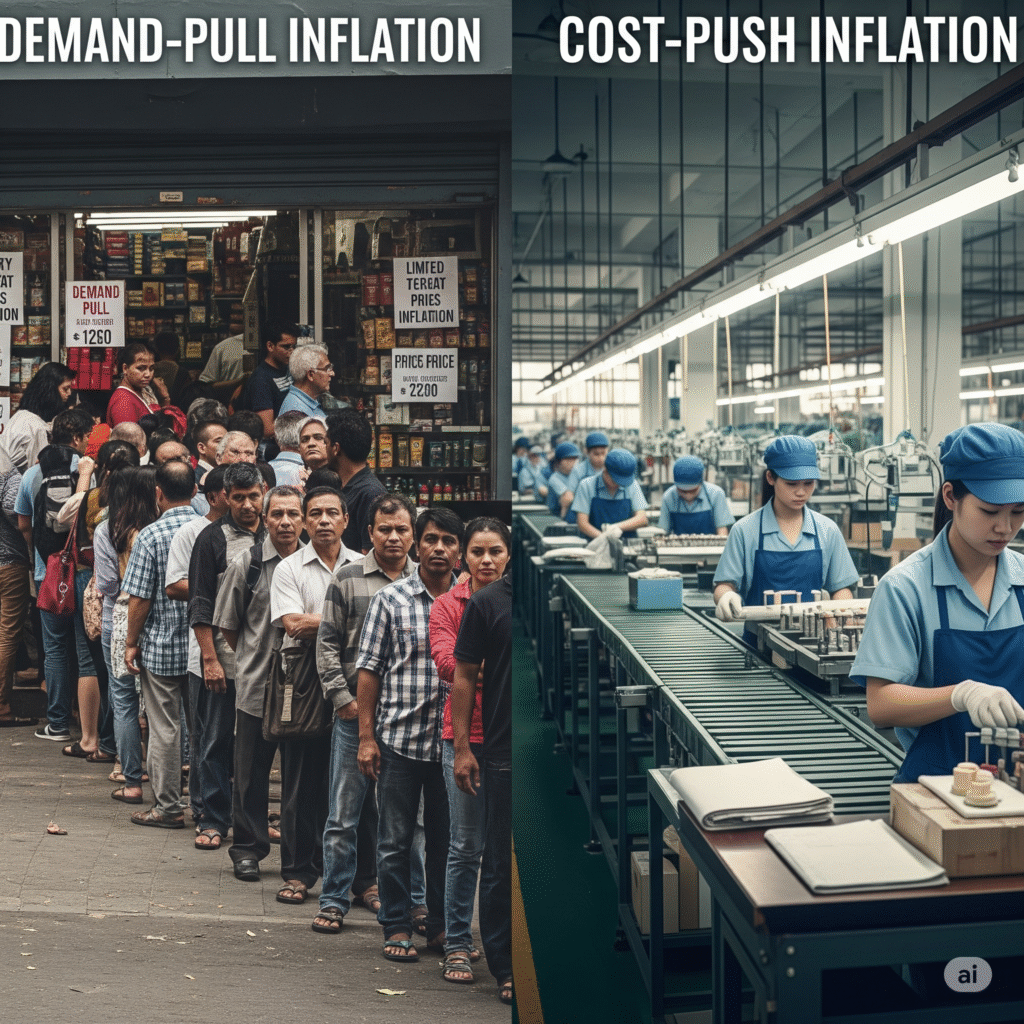

Demand-Pull Inflation

That occurs when there are too many consumers chasing too few goods and services. When more individuals are vying to get the same stuff, businesses may charge higher prices. Example: In an economic recovery after a downturn, spending tends to rise rapidly, and that drives demand-pull inflation.

Cost-Push Inflation

It happens when the cost of making things goes up — think wages, materials or fuel — and businesses pass those cost on to consumers. Example: When oil becomes more expensive, so too does shipping, which can result in more expensive groceries and consumer goods.

Other contributing factors include:

- Financial policy (e.g., low interest rates or expanded money supply)

- Supply chain disruptions

- Government spending

- Political unrest (e.g., wars or trade embargoes)

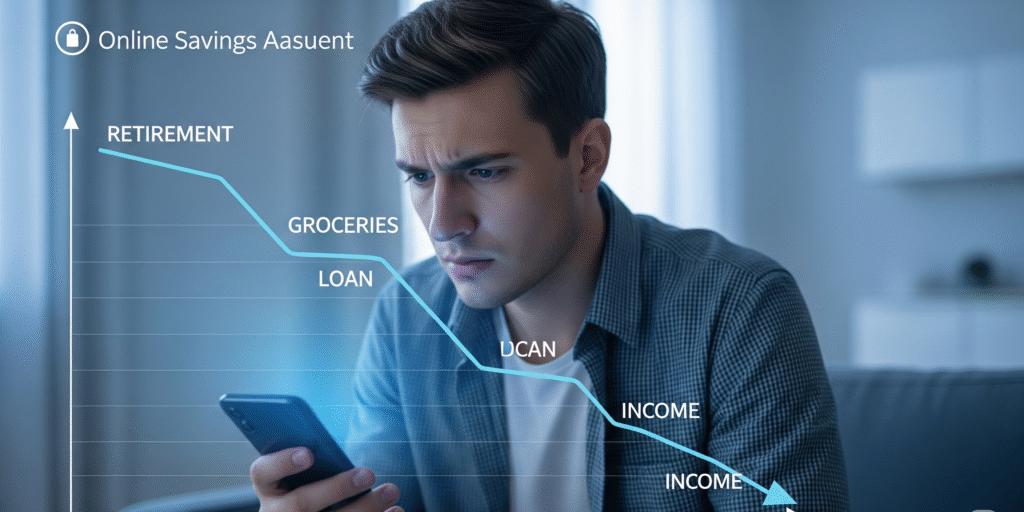

How Inflation Affects Your Money

And inflation doesn’t just concern prices — it has a direct effect on your savings, your income, your investments, and your everyday life.

Reduced Purchasing Power

When inflation goes up, the identical sum of money purchases less stuff. Over the long run, this can eat away at your standard of living if your income doesn’t grow to match.

Erosion of Savings

Cash left in a low-interest savings account loses value when inflation outpaces the interest being earned. If, for example, your money is earning 1% interest but inflation is running at 4%, then your balance is losing 3% of its value every year.

Impact on Fixed Incomes

Someone who’s retired and living on a fixed pension or annuity can be hurt during times of high inflation, because his or her income doesn’t automatically adjust to account for rising prices.

Higher Cost of Borrowing

Central banks like the Federal Reserve typically increase interest rates to battle inflation. That makes it more expensive to borrow (for mortgages, credit cards, student loans).

Stock Market Volatility

Inflation can threaten corporate profits, especially if companies cannot pass along higher costs to consumers. This kind of uncertainty is among the factors that contribute to the kind of stomach-churning stock markets.

Historical Examples of Inflation

- U.S.A. 1970s Stagflation: A mix of unduly high inflation and weak growth, producing the worst recovery since the Depression, largely because of oil shocks and loose money.

- Hyperinflation in Zimbabwe (2008): Prices doubled every 24 hours, and the currency was essentially worthless.

- Post-COVID Surge (2021–2023): Supply issues with the supply chain, as well as stimulus spending and pent-up demand, brought inflation to the highest rates since 40 years in the U.S., exceeding 9% in 2022.

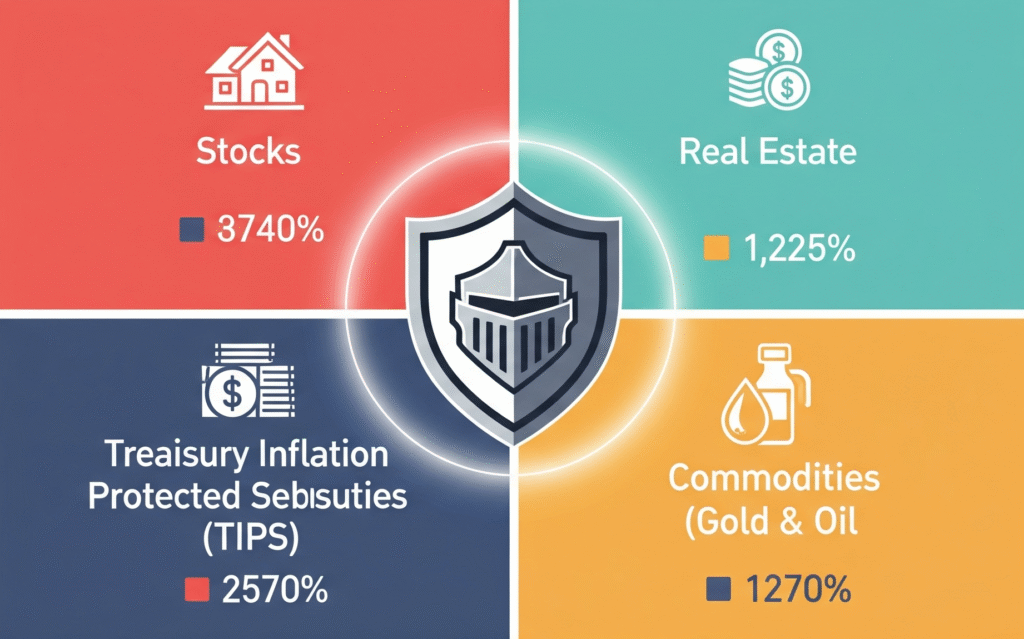

How to Defend Against Inflation

Invest in Inflation-Hedging Assets

- Stocks (in particular in energy, consumer staples, and utilities)

- Real Estate and REITs

- Commodities (gold, oil)

- Treasury Inflation-Protected Securities (TIPS)

Build a Diversified Portfolio

Investing in a well-crafted blend of stocks, bonds and alternative investments can protect you to some degree against inflation for this reason.

Prioritize High-Yield Savings and CDs

You can move into high-interest saving accounts or certificates of deposit (CDs) that protect against erosion from inflation.

Negotiate Your Income

Look for work or freelance jobs that can grow at least in line with inflation. And don’t be shy about asking for raises often, especially when inflation is flying high.

Cut Unnecessary Spending

Adjust your budget frequently. Lean into value-based spending and resist recurring spending that inflation could crush (like a subscription services, takeout meals).

Inflation and the Federal Reserve

In the United States, the Federal Reserve is charged with ensuring price stability and maximum employment. If inflation climbs over their 2% annual target, the Fed can raise rates to cool off economic activity. These rate increases have an effect on everything from the interest rate on your mortgage to the rate you may pay for a credit card, and it influences borrowers and savers alike.

Inflation in Retirement Planning

Everybody knows that including inflation is important in preparing for retirement. Here’s how to account for it:

- Relies on a modest rate of inflation (e.g. 3%) when estimating future costs.

- Add more to your retirement accounts every year to help match inflation.

- Buy assets with long-term growth potential, such as stock or inflation-adjusted bonds.

Inflation: Friend or Foe?

While it’s commonly frowned upon, moderate inflation is an indicator of an expanding economy. It incentivizes spending and investment over hoarding money. Troubles come only when inflation is too high, or too low, (deflation).

Conclusion

Inflation is such a potent economic force that it affects virtually every aspect of your financial life. From the cost of your groceries to your retirement savings, knowing what inflation is and how it works is vital to making intelligent financial decisions. By keeping your nose to the newsprint, making smart investments, and adjusting your budget and savings strategies, you can even turn the tide of inflation in your favor.