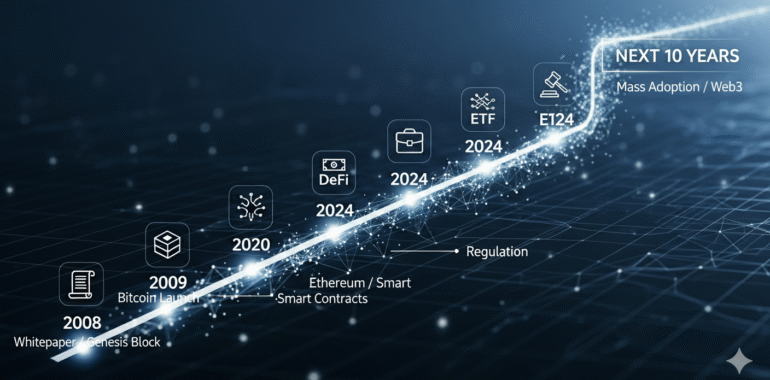

A Timeline of Major Crypto Events and the Next 10 Years of the Market

A Timeline of Major Crypto Events and the Next 10 Years of the Market

Published in August 2025 | Category: Crypto

Cryptocurrencies have evolved from a niche digital experiment to a global financial force. Over the past 15 years, the crypto world has experienced explosive growth, innovation, regulation, and turbulence. Understanding where the industry is headed requires a look back at the key events that shaped it—and a realistic projection of its next decade.

Table of Contents

- A Brief Timeline of Key Events in Crypto History

- Where Is the Crypto Market Headed in the Next 10 Years?

- Conclusion

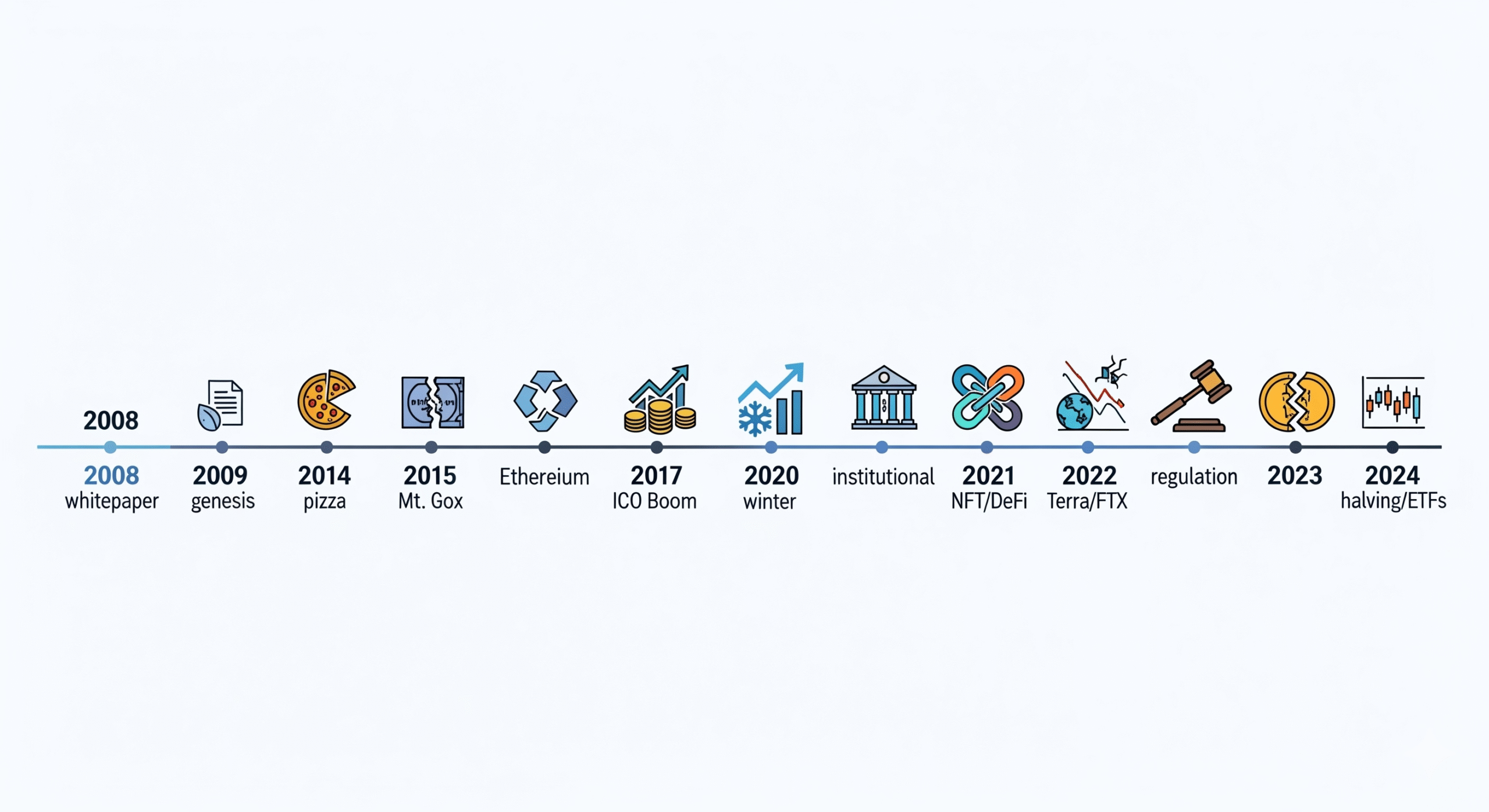

A Brief Timeline of Key Events in Crypto History

2008 – The Bitcoin Whitepaper

In October 2008, an anonymous figure known as Satoshi Nakamoto published “Bitcoin: A Peer-to-Peer Electronic Cash System.” The paper introduced a decentralized, trustless digital currency powered by a blockchain, a tamper-resistant, distributed ledger.

2009 – Bitcoin Network Launch

On January 3, 2009, the first block of the Bitcoin blockchain—the Genesis Block—was mined. It embedded the message: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,” signaling both a technological and philosophical shift.

2010 – The First Real Bitcoin Transaction

Developer Laszlo Hanyecz paid 10,000 BTC for two pizzas, the first widely recognized real-world crypto purchase—now celebrated as Bitcoin Pizza Day.

This content may interest you!

2011 – Altcoins Emerge

Projects such as Litecoin and Namecoin appeared, experimenting with new features and consensus variations beyond Bitcoin.

2013 – Bitcoin Hits $1,000 and Mt. Gox Issues

Bitcoin crossed the $1,000 mark, drawing mainstream attention. Meanwhile, warning signs emerged at Mt. Gox, then the dominant exchange, around security and liquidity.

2014 – Mt. Gox Collapse

Mt. Gox filed for bankruptcy after losing about 850,000 BTC, allegedly due to hacking and mismanagement—an event that reshaped security expectations for centralized exchanges.

2015 – Ethereum Launches

Ethereum introduced smart contracts—self-executing programs on a blockchain—expanding crypto’s scope from money to dApps and programmable finance.

2017 – ICO Boom and Bitcoin’s New ATH

The ICO boom let startups raise billions with limited oversight. By year-end, Bitcoin hit a new all-time high near $20,000, fueling mass retail interest.

2018 – The Crypto Winter

Following the frenzy, a severe bear market erased over 80% of market cap. Many ICOs failed, yet infrastructure quietly improved.

This content may interest you!

2020 – Institutional Adoption Begins

Amid COVID-19, firms like MicroStrategy, Tesla, and Square added Bitcoin to treasuries, positioning it as an inflation hedge.

2021 – NFTs and DeFi Go Mainstream

NFTs and DeFi surged via platforms like OpenSea, Uniswap, and Aave. Bitcoin set a new ATH around $69,000 in November.

2022 – Terra/Luna Collapse and FTX Scandal

The failure of Terra/Luna and the bankruptcy of FTX underscored the need for transparency, proper risk management, and stronger regulation.

2023 – Regulation Takes Center Stage

Regulators worldwide advanced frameworks—e.g., the EU’s MiCA and U.S. enforcement actions—aimed at reducing fraud while preserving innovation.

2024 – Bitcoin Halving and ETF Milestones

Bitcoin’s halving reduced miner rewards, reinforcing programmed scarcity. Approvals of spot Bitcoin ETFs expanded institutional access to crypto as an asset class.

Where Is the Crypto Market Headed in the Next 10 Years?

1. Mass Adoption and Real-World Integration

As user-friendly wallets, payment gateways, and stablecoins mature, crypto will integrate into everyday transactions—subscriptions, retail payments, remittances. More CBDCs could arrive, blurring lines between decentralized networks and state-issued digital money.

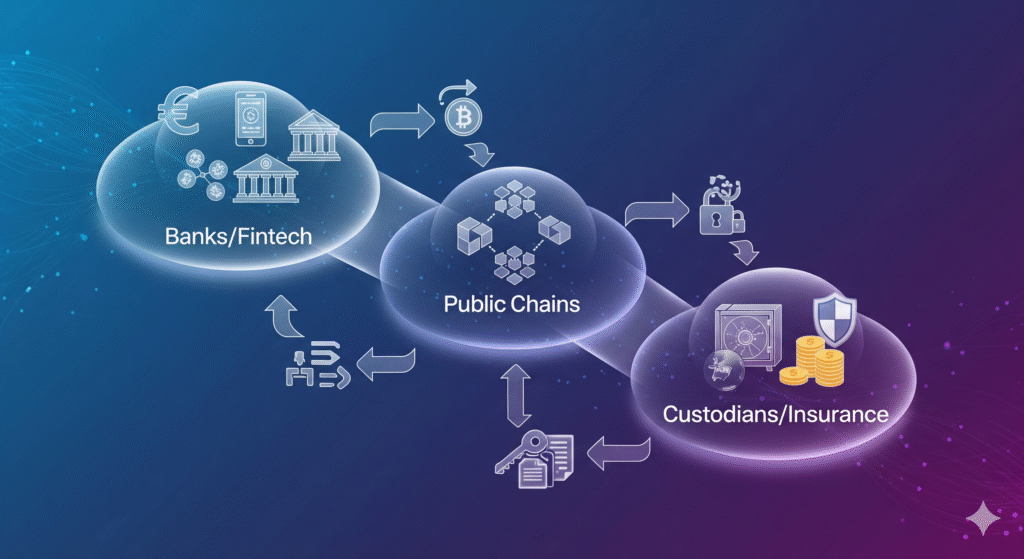

2. Institutional Maturity

Expect more ETFs, broader involvement by banks and hedge funds, and deeper custody and insurance markets. Traditional finance and crypto are likely to coexist in a hybrid system, with improved reporting, risk controls, and operational standards.

3. Interoperability and Blockchain Infrastructure

Projects like Polkadot, Cosmos, and Layer-2 networks (Optimism, Arbitrum, various zk-rollups) aim to connect chains and scale throughput. Cross-chain bridges and shared security models will help assets and data move more freely and safely.

This content may interest you!

4. DeFi Will Reshape Traditional Finance

Decentralized Finance could offer regulated, transparent alternatives to legacy banking: decentralized credit scoring, algorithmic insurance, and tokenized securities (bonds, equities) on-chain. As compliance frameworks solidify, DeFi’s utility—not just yield—should drive adoption.

5. Web3 and Digital Identity

Web3 will anchor ownership and identity online. Decentralized Identifiers (DIDs), verifiable credentials, and portable profiles can return data control to users, enabling decentralized social, education, and commerce platforms with native monetization.

6. AI and Crypto Convergence

The intersection of AI, blockchain, and IoT will unlock new markets: decentralized AI model marketplaces, on-chain provenance for training data, and verifiable model outputs. Smart contracts can automate payments for compute, data, and model usage.

7. Tighter Regulations and Compliance

Clearer AML/KYC rules, consumer protections, and tax guidance will normalize participation and reduce fraud. Thoughtful regulation can preserve decentralization’s benefits while protecting users—especially around stablecoins, exchanges, and custody.

8. Environmental Sustainability

With Ethereum’s Proof of Stake cutting energy use dramatically and renewable-powered mining expanding, environmental metrics will remain central to network design and adoption narratives. Expect “green” chains and efficient Layer-2 solutions to lead growth.

Conclusion

From a nine-page whitepaper in 2008 to a multi-trillion-dollar ecosystem, crypto has already reframed how we think about money, ownership, and trust. The last 15 years show a repeating pattern: periods of rapid innovation and adoption, followed by painful resets that expose weak governance, excessive leverage, or poor risk controls. Each cycle left the industry more resilient, with better infrastructure (custody, compliance, developer tooling) and clearer regulatory expectations. That arc—experimentation → stress test → hardening—will likely continue.

What the last 15 years teach

- Technology compounds, but trust is earned: Breakthroughs like smart contracts, Layer-2 scaling, and Proof of Stake can’t replace sound risk management, transparent accounting, and user education.

- Decentralization is a spectrum: Markets reward usable systems. Designs that balance decentralization, security, and usability win out over purely ideological extremes.

- Regulation follows utility: As use cases mature (payments, stablecoins, DeFi, tokenized assets), policy becomes more specific. Clear rules lower the cost of capital and attract institutions.

Plausible paths for the next decade

- Base case: A hybrid system where banks, fintechs, and public blockchains interoperate. Stablecoins and tokenized deposits power payments; DeFi provides regulated, transparent market plumbing; CBDCs coexist with open networks.

- Upside case: Seamless interoperability (cross-chain messaging, shared security) + scalable Layer-2 and zk-rollups push on-chain settlement into mainstream consumer apps (commerce, gaming, identity).

- Guarded case: Patchy rules, recurring exchange failures, or smart-contract exploits slow consumer trust. Adoption consolidates in a few well-governed networks; self-custody and audits become mandatory norms.

Key signals to watch

- Policy clarity: Stablecoin statutes, spot ETF approvals, tax guidance, and licensing regimes for exchanges/custodians.

- Real-world tokens: Tokenized T-bills, funds, and invoices with measurable settlement savings and audited reserves.

- UX breakthroughs: Account abstraction, social recovery, and fee-sponsored transactions that hide blockchain complexity.

- Security posture: Formal verification, on-chain insurance, standardized audit disclosures, and incident response playbooks.

Practical takeaways for readers

- Prefer transparency: Use platforms with proof-of-reserves, audited smart contracts, and clear disclosures.

- Diversify and size risk: Treat crypto as one sleeve of a broader plan; understand volatility, smart-contract and custodial risks.

- Focus on utility: Payments, remittances, stablecoins, tokenized assets, and compliant DeFi rails tend to endure beyond hype cycles.

- Invest in literacy: Learn self-custody basics (keys, seed phrases), phishing defenses, and how to read on-chain data.

Ultimately, crypto’s long-term relevance will hinge less on price charts and more on reliable settlement, programmable finance, and verifiable data that individuals and institutions can depend on. If the industry continues to pair technical progress with strong governance, risk controls, and user-centric design, the next decade will feel less like speculation—and more like critical digital infrastructure quietly doing its job.