Types of Cryptocurrencies

Types of Cryptocurrencies

Published in August 2025 | Category: Crypto

Since the invention of Bitcoin (BTC) in 2009, the cryptocurrency market has exploded, with thousands of digital assets now in circulation. These cryptocurrencies vary widely in terms of function, technology, purpose, and value. Some are used as digital money, others enable smart contracts, power decentralized applications (dApps), or represent physical or virtual assets.

Understanding the different types of cryptocurrencies is crucial for anyone interested in this fast-evolving digital ecosystem. While the market is diverse, most cryptocurrencies fall into a few major categories.

Table of Contents

- 1. Bitcoin (BTC) – The First and Most Dominant Cryptocurrency

- 2. Altcoins – Alternatives to Bitcoin

- 3. Stablecoins – Price Stability in a Volatile Market

- 4. Utility Tokens – Fuel for Blockchain Applications

- 5. Security Tokens – Digital Representation of Assets

- 6. Governance Tokens – Voting Power in Decentralized Protocols

- 7. Meme Coins – Community-Driven and Speculative

- 8. Non-Fungible Tokens (NFTs) – Unique Digital Assets

- 9. Privacy Coins – Enhanced Anonymity

- Final Thoughts

1. Bitcoin (BTC) – The First and Most Dominant Cryptocurrency

Bitcoin is the original cryptocurrency and remains the most valuable and well-known digital asset. It was created by Satoshi Nakamoto as a peer-to-peer payment system that functions without the need for intermediaries like banks.

Key features of Bitcoin:

- Fixed supply of 21 million coins

- Proof of Work (PoW) consensus mechanism

- Strong emphasis on decentralization and security

- Often referred to as “digital gold” due to its limited supply and role as a store of value

Over time, Bitcoin has shifted from being seen as a means of payment to being considered a hedge against inflation and a long-term investment asset.

2. Altcoins – Alternatives to Bitcoin

The term altcoin refers to any cryptocurrency that is not Bitcoin. These include a wide range of projects with different use cases and technologies. Some are direct forks of Bitcoin, while others are completely new blockchains.

Examples of altcoins:

- Litecoin (LTC): A Bitcoin fork with faster block times and lower fees.

- Bitcoin Cash (BCH): Created to allow larger block sizes for faster transactions.

- Monero (XMR): Focused on privacy and untraceable transactions.

- Zcash (ZEC): Offers optional privacy features using zero-knowledge proofs.

While many altcoins attempt to improve upon Bitcoin’s limitations, not all succeed or maintain value in the long term.

3. Stablecoins – Price Stability in a Volatile Market

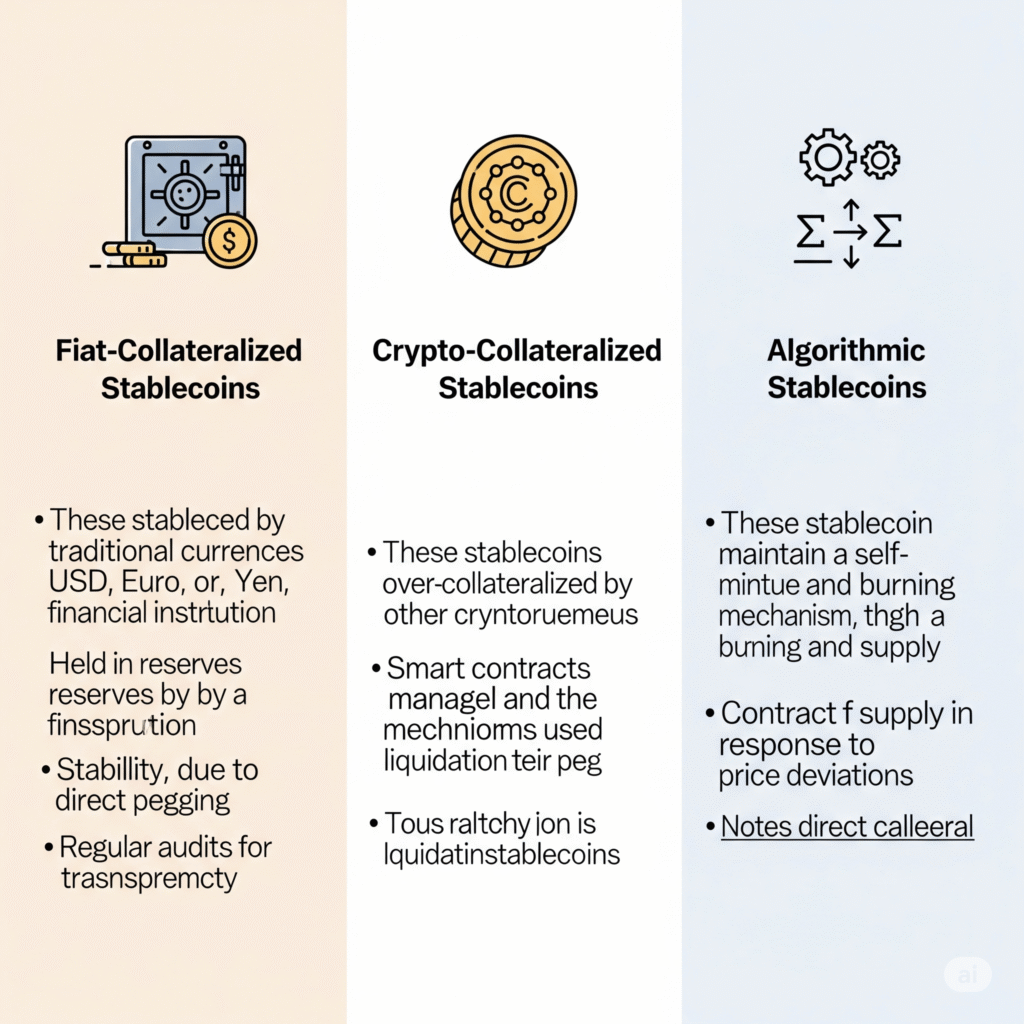

One of the major issues with cryptocurrencies is volatility. Stablecoins were created to counter this by pegging their value to traditional assets, such as fiat currencies or commodities.

Main types of stablecoins:

- Fiat-collateralized: Backed 1:1 by a fiat currency like USD (e.g., USDT, USDC, BUSD)

- Crypto-collateralized: Backed by other crypto assets (e.g., DAI)

- Algorithmic stablecoins: Use smart contracts to manage supply and demand without physical collateral (e.g., AMPL; this category is riskier)

Use cases of stablecoins:

- Quick, low-fee cross-border transactions

- On-chain lending and borrowing (DeFi)

- Storing value during market downturns

4. Utility Tokens – Fuel for Blockchain Applications

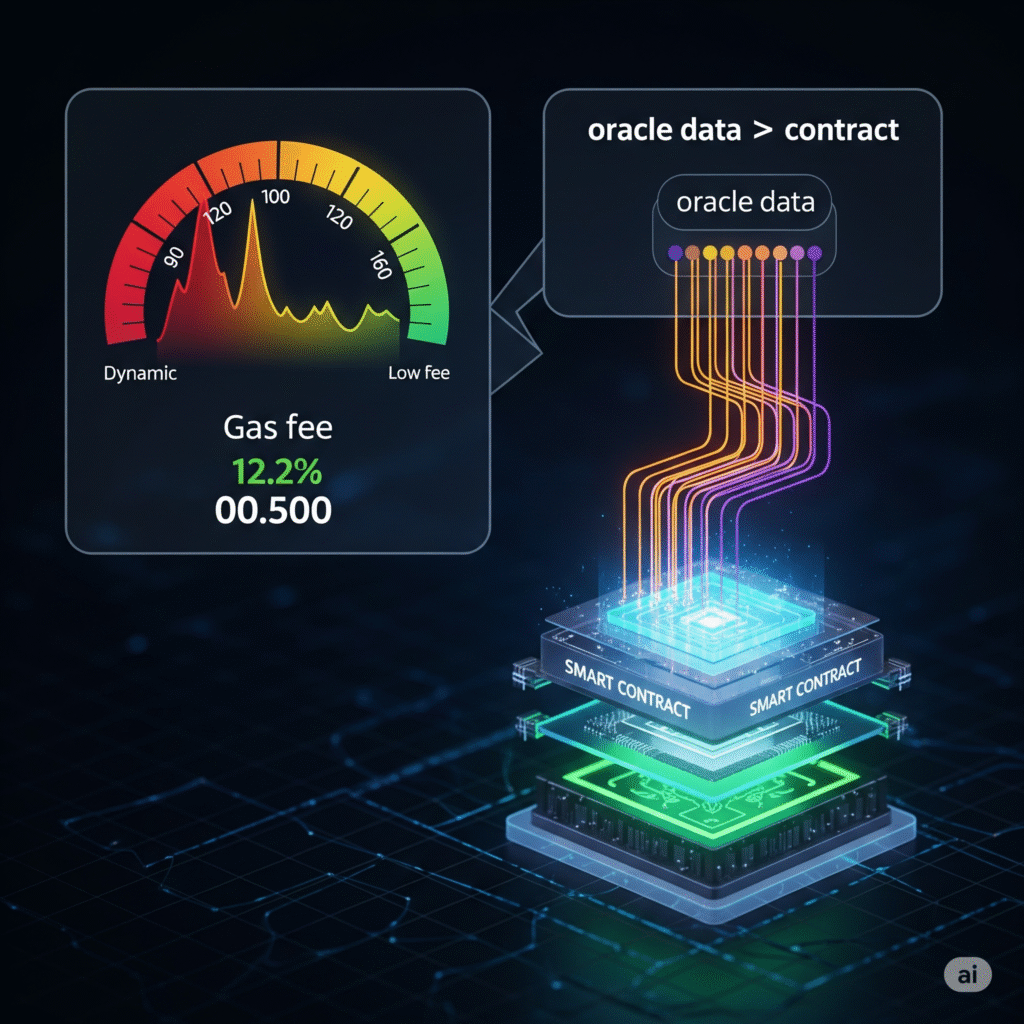

Utility tokens give holders access to a specific product or service within a blockchain-based platform. These tokens are not meant to function as digital money, but rather as tools to interact with decentralized apps or protocols.

Examples:

- ETH (Ethereum): Powers the Ethereum network and is required to execute smart contracts and pay gas fees.

- BNB (BNB Chain): Used to pay trading fees and access services within Binance’s ecosystem.

- LINK (Chainlink): Facilitates decentralized oracle networks that feed external data into smart contracts.

Utility tokens are essential to the functioning of many decentralized systems and are often used as incentive mechanisms for users and developers.

5. Security Tokens – Digital Representation of Assets

Security tokens represent ownership in real-world assets, such as stocks, real estate, or company equity. These tokens are regulated under securities laws and often issued through Security Token Offerings (STOs).

Key characteristics:

- Backed by tangible or financial assets

- Must comply with securities regulations

- Allow for fractional ownership

- Can be traded on licensed digital asset exchanges

Security tokens aim to bring liquidity and efficiency to traditional markets, making investing more accessible and transparent.

6. Governance Tokens – Voting Power in Decentralized Protocols

Governance tokens are used to give holders voting rights over changes to a blockchain protocol or decentralized application. This is a core component of Decentralized Autonomous Organizations (DAOs), where decisions are made collectively by the community.

Examples:

- UNI (Uniswap): Allows holders to vote on protocol upgrades and development.

- MKR (MakerDAO): Enables voting on risk parameters for the DAI stablecoin system.

- AAVE (Aave): Used for governance over the lending protocol.

Governance tokens empower communities to shape the future of decentralized systems and align incentives between developers and users.

7. Meme Coins – Community-Driven and Speculative

Meme coins often start as jokes or internet trends, but some have grown into massive communities and high market valuations. These coins are generally high-risk and speculative, but they highlight the power of online communities and social media in the crypto space.

Popular meme coins:

- Dogecoin (DOGE): Started as a parody of Bitcoin, now accepted by major merchants.

- Shiba Inu (SHIB): Created as a “Dogecoin killer,” with its own ecosystem and tokenomics.

- Pepe (PEPE): A recent example of a meme coin that gained traction rapidly.

While many meme coins lack real utility, they can be powerful cultural phenomena, and some evolve to incorporate real-world use cases.

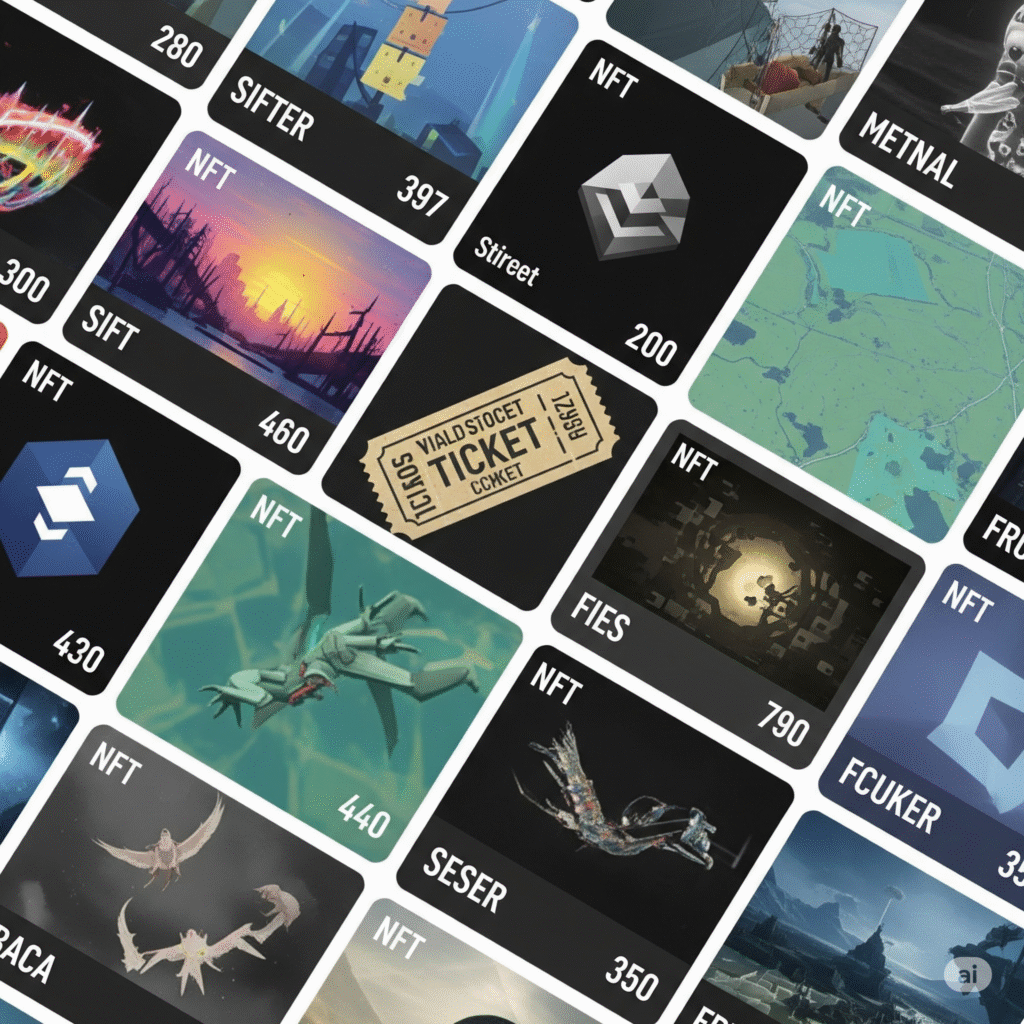

8. Non-Fungible Tokens (NFTs) – Unique Digital Assets

Technically, NFTs are not cryptocurrencies in the traditional sense because they are non-fungible, meaning each token is unique and cannot be exchanged on a 1:1 basis like BTC or ETH.

However, NFTs are built on blockchain networks and have exploded in popularity for use cases such as:

- Digital art and collectibles

- Virtual real estate and in-game assets

- Event tickets and identity verification

- Intellectual property and copyrights

NFTs typically use ERC-721 or ERC-1155 token standards on Ethereum or similar protocols on Solana, Polygon, and others.

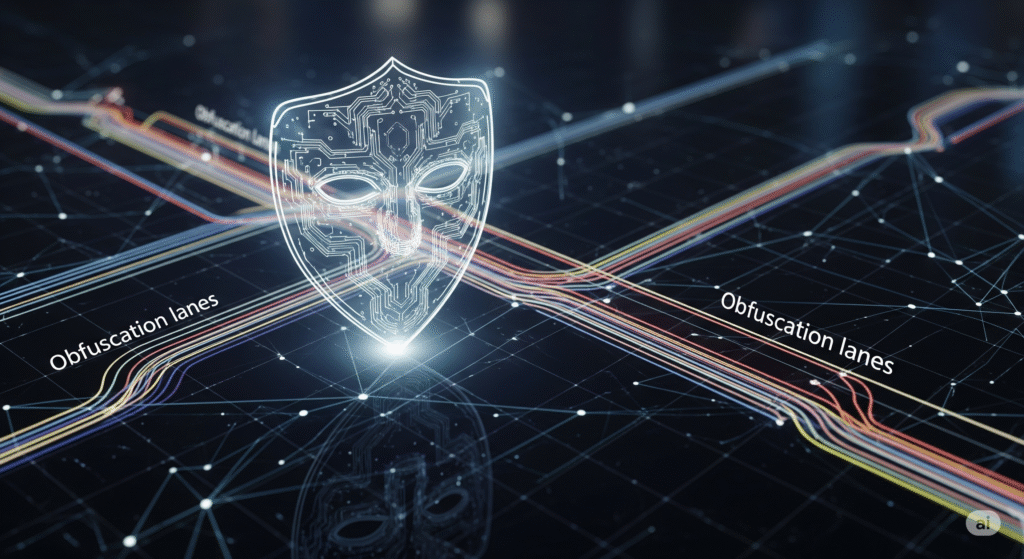

9. Privacy Coins – Enhanced Anonymity

While most blockchains are transparent, privacy coins are designed to obfuscate transaction details, protecting user identity and transaction data.

Examples:

- Monero (XMR): Uses stealth addresses and ring signatures for full anonymity.

- Zcash (ZEC): Offers shielded and transparent addresses with zk-SNARKs technology.

- Dash (DASH): Offers optional privacy features through PrivateSend.

Privacy coins are controversial, as they offer financial privacy but also attract scrutiny from regulators concerned about illicit activity.

Final Thoughts

The cryptocurrency world is vast and continuously evolving. While Bitcoin laid the foundation, thousands of other cryptocurrencies have emerged, each with unique purposes, innovations, and communities.

Understanding the different types of cryptocurrencies helps investors, developers, and users navigate the ecosystem more effectively and make informed decisions. Whether you’re interested in decentralization, investing, smart contracts, or simply exploring a new financial system, there’s likely a category of cryptocurrency that aligns with your goals.

As always, caution is essential — not all cryptocurrencies have long-term potential, and due diligence is critical before engaging with any project.