Understanding Risk Tolerance: A Guide for First-Time Investors

Understanding Risk Tolerance: A Guide for First-Time Investors

Published in August 2025 | Category: Investment

Table of Contents

- What Is Risk Tolerance?

- Why Understanding Risk Tolerance Matters

- The Three Main Types of Risk Tolerance

- How to Assess Your Risk Tolerance

- Tailoring Your Portfolio Based on Risk Tolerance

- Risk Capacity vs. Risk Tolerance: What’s the Difference?

- How Risk Tolerance Changes Over Time

- Using Technology to Align With Risk Tolerance

- Strategies to Manage Risk Regardless of Tolerance

- Conclusion: Know Yourself Before You Invest

What Is Risk Tolerance?

Risk tolerance refers to the amount of loss an investor is willing to endure within their portfolio. It’s the measure of how comfortable you are with market volatility and the potential for losing money in the short term in exchange for long-term growth.

Risk tolerance is highly personal and depends on several factors:

- Age

- Income

- Investment time horizon

- Financial goals

- Experience with investing

- Emotional capacity to handle market fluctuations

Understanding this tolerance helps you avoid impulsive decisions during market downturns and aligns your portfolio with your long-term strategy.

Why Understanding Risk Tolerance Matters

Failing to assess your risk tolerance can result in emotional decision-making—such as panic-selling during market crashes or overinvesting in volatile assets driven by hype. These decisions often lead to poor long-term performance and financial stress.

On the other hand, aligning your investments with your risk tolerance:

- Improves your ability to stay invested during downturns

- Helps you sleep better at night

- Keeps your goals realistic and achievable

- Encourages consistency and discipline

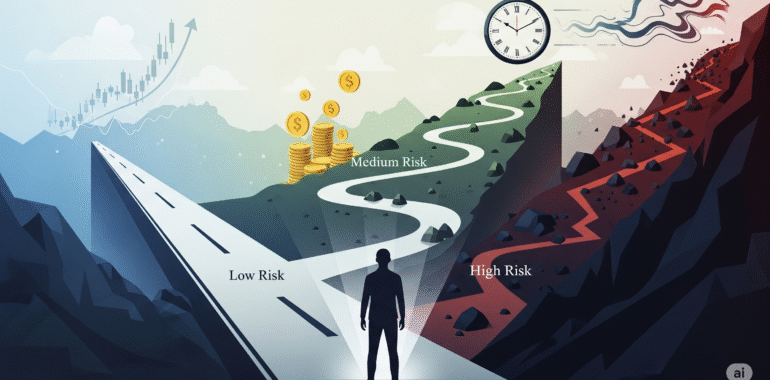

The Three Main Types of Risk Tolerance

While risk tolerance exists on a spectrum, it is generally categorized into three main types:

1. Conservative

- Focuses on preserving capital

- Prefers stable, low-return investments like government bonds or high-yield savings accounts

- Ideal for short-term goals or individuals close to retirement

2. Moderate

- Accepts some risk for moderate gains

- Typically mixes stocks and bonds in a balanced way

- Suitable for medium to long-term goals like buying a house or funding a child’s education

3. Aggressive

- Prioritizes high growth, accepting high volatility

- Heavy allocation in equities, emerging markets, or alternative investments like crypto

- Best for younger investors with long-term horizons and higher disposable income

How to Assess Your Risk Tolerance

Determining your risk tolerance requires a blend of self-reflection and financial analysis. Here are several ways to do it:

1. Ask Yourself Key Questions

- How would I feel if my investments lost 20% of their value in a month?

- Am I relying on this money in the near future?

- Can I afford to lose part of my investment without affecting my lifestyle?

2. Use Risk Tolerance Quizzes

Online platforms such as Vanguard, Fidelity, or Charles Schwab offer free risk tolerance questionnaires that assess your comfort with hypothetical investing scenarios.

3. Review Your Financial Situation

Look at your income stability, monthly expenses, emergency fund, and investment horizon. If your income is unpredictable or your goals are short-term, you may need a lower-risk approach.

4. Monitor Emotional Reactions

Track your responses to market news or investment swings. If checking your portfolio causes anxiety, your current investment strategy may not match your tolerance level.

You might also like!

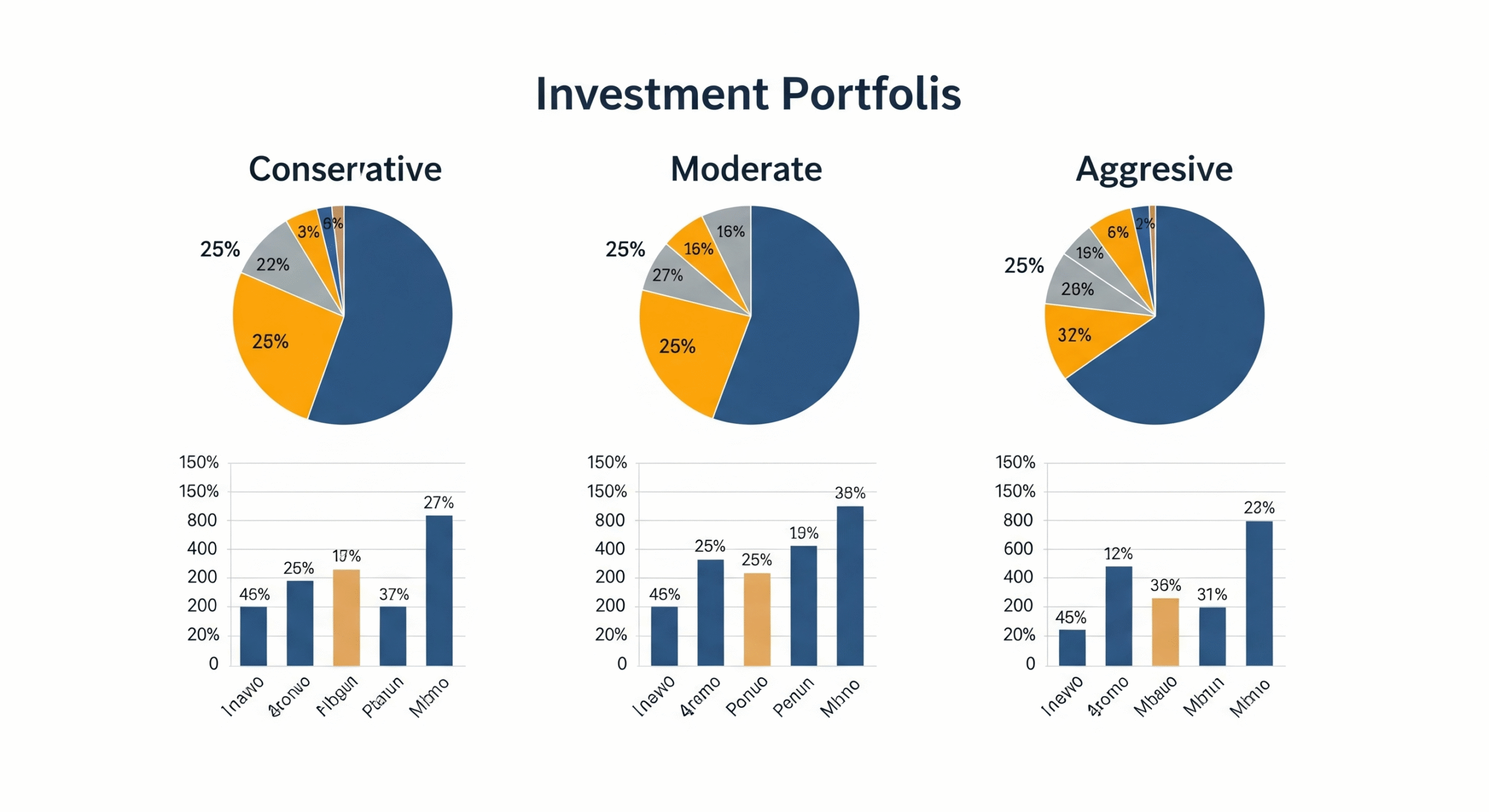

Tailoring Your Portfolio Based on Risk Tolerance

Once you’ve assessed your tolerance, it’s time to build a portfolio that reflects your risk profile.

Conservative Portfolio Example

- 70% bonds (government and corporate)

- 20% dividend-paying stocks

- 10% cash or short-term CDs

Moderate Portfolio Example

- 50% stocks (domestic and international)

- 40% bonds

- 10% real estate (REITs) or alternative investments

Aggressive Portfolio Example

- 80% stocks (including growth and international)

- 10% real estate or crypto

- 10% bonds

These allocations are only guidelines—your strategy should adapt over time as your goals, income, and experience evolve.

Risk Capacity vs. Risk Tolerance: What’s the Difference?

Risk tolerance is how much risk you’re emotionally comfortable with.

Risk capacity is how much risk you can financially afford to take.

For example, a young investor may have high risk tolerance emotionally, but limited risk capacity due to low income or no emergency fund. The two should be evaluated together to avoid financial overexposure.

How Risk Tolerance Changes Over Time

Risk tolerance is not fixed. It evolves with life changes such as:

- Getting married or having children

- Career transitions

- Major purchases (e.g., buying a house)

- Retirement planning

Periodic reassessment is essential—experts recommend evaluating your risk tolerance annually or after major life events.

Using Technology to Align With Risk Tolerance

Many investment platforms now use robo-advisors that build personalized portfolios based on your risk profile. Examples include:

- Betterment: Automatically adjusts allocations over time

- Wealthfront: Offers tax-loss harvesting and risk parity

- M1 Finance: Combines automation with customization

These tools remove emotion from the equation while keeping you aligned with your profile.

Strategies to Manage Risk Regardless of Tolerance

No matter your tolerance level, some universal strategies can help manage investment risk:

- Diversify: Spread investments across asset classes and industries

- Rebalance periodically: Keep your portfolio aligned with your desired risk exposure

- Stay invested: Avoid trying to time the market

- Keep costs low: Choose index funds with minimal fees

Conclusion: Know Yourself Before You Invest

Understanding your risk tolerance isn’t just about choosing the right investments—it’s about aligning your finances with your values, goals, and peace of mind. As a first-time investor, taking the time to assess your emotional and financial readiness for market fluctuations is one of the smartest moves you can make.

Remember, successful investing is not just about chasing returns. It’s about consistency, patience, and a strategy that works for you in both good times and bad.